Passive Income Ideas

Passive income ideas is broad and diverse. With each method’s unique set of benefits, challenges, and prerequisites, the exploration of passive income can be a captivating journey for those seeking to diversify their income streams and decrease dependence on conventional employment. Income that comes from ventures where a person doesn’t engage in daily activities is known as passive income. A return on investment through regular means is a desirable outcome for this income stream. Passive income options that are commonly used include rental properties, where profits are derived from rent payments made by tenants, and dividend stocks, which provide regular dividends from company profits.

A different option is producing electronic books or online materials that can be sold multiple times without any additional effort. This is known as digital products. Other common practices include peer-to-peer lending and investing in assets that yield interest, such as bonds or savings accounts. The initial investment of time, money or both in these methods can lead to a steady stream of income with minimal daily activities. The strategic use of passive income streams can contribute to financial stability and accumulation over time. i.e, wealth.

The article’s good portion is now in its final stages. The premise of this passive income ideas is pretty straightforward and typically happens online. Here, you’ll be exposed to the multiple approaches to generate passive income.

As mentioned earlier, some are going to require a financial investment while others will mostly need effort (and a minimal budget). And in light of keeping your expenses at a minimum, we are going to start with the channels that focus more on effort and determination. And as the article fleshes out, we’ll include more risky options.

Visit The Info Page Today And Have Our Coaching Staff Helping Out!

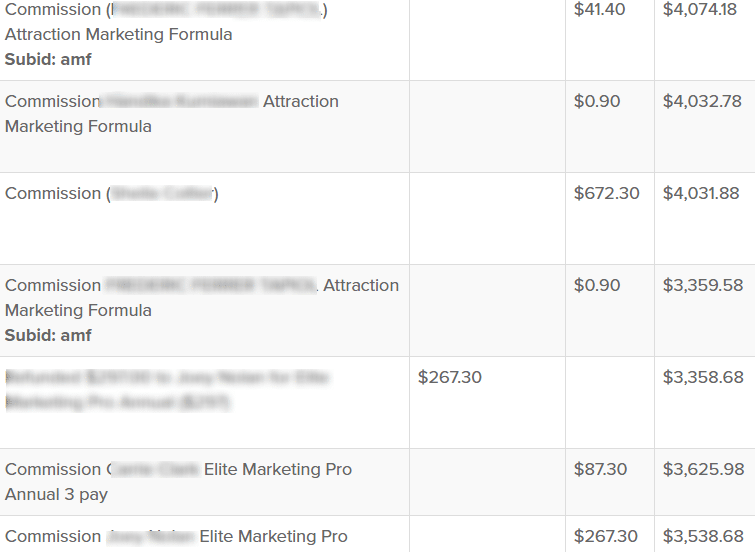

Affiliate Marketing

It doesn’t really get much safer and affordable than affiliate marketing. Why? Because you don’t need to put in any money if you don’t want to, so there is no risk of losing anything except your time. Of course, if you feel a little bit of a financial boost can help you, you are at liberty to use it. But if you are totally strapped for cash, and you need an opportunity where the determination is all you have, affiliate marketing might just be for you.

You choose products that you think you’ll be able to “sell” online, although you don’t really handle the sale. Instead, you lead people to the sales page, and hopefully, you convinced them to make the purchase.

The first challenge is small, and it involves finding an affiliate program you are comfortable with. In other words, you agree with the cut you get when a sale is made and you have confidence you can convince people to buy the product.

Then you need to either create a website or social media platform where you can start marketing this product. A good example would be the affiliate program by Amazon. You choose the items that will fit with your site and social media page, then you start writing content on the items.

If you are going to convince people to buy something, you need to show them you are an expert in the area. Plus, your pitch has to come from an authority position, otherwise, nobody is going to follow the link.

Make no mistake; it will not be easy to get an affiliate marketing campaign to the point where it makes money. But when you do reach that point and master your skills, you’ll be tapping into a very significant source of passive income.

Sell Advertising Space On A Website

The second passive income idea is also based online, and yes, going online is incredibly affordable. Given that it automatically connects you to a big network of people and potential, there is no telling what you’ll be able to do on there.

But in this particular case, you want to generate an extra income while watching the game. And it all starts by establishing a blog or a website. Of course, it should be one that you find interesting and that you can write a lot of content about.

However, you shouldn’t be thinking about money for the first few months. Instead, you want to focus on getting as much organic traffic to your site as possible. Now, there are several ways you can do this. One of them is called search engine optimization, and the tactics involved with this practice helps you to reach the front pages.

When you reach the front pages, you’ll start enjoying a huge flow of organic traffic and online authority. And this is exactly what will make your website worth investing in. Once you can boast with a strong flow of traffic, your options start to jump open.

For example, you can sell ad space privately to companies offering products within the niche you are writing. Or you can make the space available to ad networks, like Google. The latter is known for paying the best rates if you have the right ad space.

Naturally, you are going to need to keep the site up to date, but you don’t need to do it every day. If you publish two or three posts a week it will show consistency on your end, and you won’t lose the audience you already have.

Publish A Book To Generate Passive income

The world of indie authors has been blown wide open, and readers haven’t focused on the big five publishing houses as much anymore. That’s because you can write a book and have it published within hours.

It is rather obvious that you’ll need some writing skills to achieve this goal, but the days of jumping through publishing hoops are over. As long as you adhere to the rules of the platform you are publishing on, there is a lot of passive money to be made.

If you are wondering about the type of books that tend to make the most money, you are looking at non-fiction titles. In other words, if you can help people develop something, or you can teach them something through the book, you won’t need the best writing skills in the world. Plus, you can get away with charging more for non-fiction books.

This doesn’t mean you can’t try your hand at writing fiction, but the competition is a little heavy on that side and there is no telling when your books will finally get the attention they deserve.

But the bottom line is that publishing books can definitely become a valuable source of passive income. And one good book can sell for years to come.

Create An Online Course

Okay, maybe you are not the best writer in the world and you aren’t the best affiliate marketer, what are your other options?

Do you have any skills you can turn into a course? Because if you are able to take your talent and break it up into an easy and teachable material, there is definitely passive income potential here.

Udemy should serve as a great example of this. Because this is a central platform where you can get just about any course under the sun. Some of them are free and some you have to pay for. Nevertheless, there are many everyday people selling their special knowledge through this platform. And once again, it will mostly require effort as supposed to money in order to utilize this channel.

Sell Your Music, Photos, And Art

This channel is specifically for the artists reading this article. And yes, you can actually sell your work online. For example, Bandcamp allows you to upload your recorded songs. From there, you can decide how much the song should sell for.

You can do the same thing with photos and artwork. Because there are always users out there in need of high-quality pictures for their websites and content. And you can be the one who supplies them with all these pictures.

From a pretty garden to somebody freaking out on a roller coaster, advertisers can really bring in some money if you have what they are looking for.

Start A YouTube Channel

Okay, this one might be a little tricky, but if you have an original idea for a great YouTube channel, why not bring it life? But how exactly are you going to establish a passive income from a YouTube channel?

Just like with starting a website to sell ad space, YouTube gives you the opportunity to show ads while your videos play. So, the more people who watch your videos, the more money you stand to make. However, you should note that YouTube works in conjunction with Google in terms of the ads getting shown. Plus, you have no control over which ads will be seen by the viewer.

During the initial stages, you are going to be the one creating traffic and buzz around the videos. Good places to do this is via social media and forums, but you are not limited to these options. Basically, you want to get as much traffic as possible watching your channel.

This means your ultimate aim when making videos should be to come up with something that has viral potential. When people see it they should feel the need to share it. But if the video isn’t interesting, entertaining, or useful, don’t expect too much interest.

Invest In Stocks

Moving away from the online scene and into a more risky territory, you can always consider investing in the stock market. But if you don’t know anything about stocks, it’s recommended that you brush up on the basics before searching for a broker.

You see, a broker is a person who will do the investing for you based on their knowledge and experience. That’s why you don’t just want any old yahoo handling your money, and neither do you want to invest in that scammy software mentioned in the beginning.

To give you an idea of the type of stock everyday people tends to invest in, cryptocurrencies are very popular right now. Although Bitcoin is taking a major dive, at one point could’ve earned you a pretty penny. But what goes up must come down, which is why you want an experienced broker or firm handling your stock market choices. Buy low and sell is the motto these people work with, and that’s how you are going to make a passive income.

Unfortunately, you need money to make money. So, if you have a few bucks you won’t be needing, it could be your chance to broaden your horizons in the economic field.

Start A Vending Machine Business

Out of all the passive income ideas so far, a vending machine business is going to cost you the most. This option is more geared to serious individuals who don’t just want an extra income. Instead, you actually want to start a business that can quickly turn into a powerful source of passive money.

But with all the potential comes a different set of challenges. For starters, you have to look at your surrounding competition and who you are going up against. Then you have to find a way to move in on their territory and surviving the first few months.

Obviously, you want to have a business mindset when setting up a vending machine business, but as far as passive income ideas go, there will always be someone looking for a vending machine.

Rent Out Your Equipment

Are you one of those people who have the right tools for everything? In fact, you have so many tools people are envious? If this is the case then you can put that equipment to good use, especially if you are not using them anymore.

You’d be surprised at how many people need a tool only once or twice in a lifetime, so it doesn’t make sense to go out and buy it. They would rather rent it and cut down on their expenses.

You can be that person people rent equipment or tools from. And if your price is competitive enough, there is no reason why you shouldn’t see a lot of growth.

Provide Small Loans

Definitely one of the risky passive income ideas, but if executed well it can bring about a significant difference in terms of your bank balance.

Peer-to-peer lending will see you helping individuals who struggle to get a small loan. In return, they pay the money back with a reasonable interest fee.

But before you use this channel, make sure you are aware of the risks involved. Not everyone can be trusted, and you need to get a vetting system in place if you don’t want to loan money to people who can’t pay it back.

Rent Out Property Or A Room

If you have property or a room that isn’t being used, why not turn it into a passive income? Of course, there are some risks involved, but the potential outweighs them.

Property isn’t something that comes cheap and how many people can actually afford to own it these days? For the most part, individuals are renting rooms and properties. You can make the most of the space or property you are not using, and you don’t even need to put in much effort.

Advertising Via Your Car

Not everybody is going to be keen on this passive income idea. But if you are serious about generating some extra money, swallow your pride and do a little research on the topic.

There are companies that pay people with cars to advertise their products. And it’s usually discreet ads that are placed in the back window of the car.

The more miles you drive with the ad, the more you get paid. However, you need to weigh the money you are making with the gas you are pouring. The last thing you want is to spend more than you are making.

Start A Small House Sitter Business

We are going to end off this guide with the easiest possible way to make money, and you don’t really do anything. And because it requires so little effort from you, it’s considered a passive income idea.

House sitting requires nothing more than watering a few plants and making sure everything stays where it should. You are also keeping potential robbers away with your presence, and this is why people pay for this service. So, consider starting a small house sitting business. Because you will literally get paid to sleep in someone else’s house.

These aren’t the only passive income ideas around, but they are fairly popular and many people have tried them. And remember, there is no such thing as quick money. Keep your expectations realistic before you get into anything, and do your best to stay positive on your journey.

Passive Income

Passive income is money that you make while you’re not involved. For instance, say that you are running a website that has ads on it that people can click on that make you money. That is you making a passive income because after you set the website up, you don’t have to do anything to earn money.

There are a lot of passive income opportunities out there, you just have to look for them. Another example would be if you were to rent out an apartment to someone and were making their rent money each month. Basically like you learned before it’s money that you make when you’re not actively involved with making it.

What can be more lucrative than earning a passive income? Just the idea of going to sleep and knowing you are generating money somewhere is more than just a little exhilarating, making you sleep better than before. But in a world filled with scams, what passive income ideas are actually worth pursuing?

This is what his article/guide is all about. Not only are we going to discuss several different passive income ideas, but we’ll also cover what you need to look out for before you pursue any opportunity that presents itself. Remember, just like it is relatively easy to generate an additional income from home, you run the risk of wasting time and money with scammers. So, it’s lucky you found this article when you did.

So, where do we start exactly? The best place would probably be the first step, namely your expectations. What are you expecting to gain out of your passive income? Do you want to be able to cover a few extra bills? Or are you looking to turn it into a business or career of sorts?

The reason why these questions are important is based on the reality of the situation. For example, certain passive income channels stand to bring in more money than others. At the same time, there are different challenges involved. Yes, you need to hear it as quickly as possible and make peace with the fact that some effort is necessary.

In addition to establishing your goals, you have to get your mind ready for how to achieve this. Because there is a huge misconception surrounding passive income ideas, and they involve making a quick buck. The fact is that a passive income doesn’t automatically quick money.

Instead, consider it as something that requires an initial investment/effort before it will show any returns. And you will need to do periodic maintenance if you want your investment/effort to keeping making those returns.

What does this all mean exactly? Well, to give you a quick breakdown of what you should know before you continue reading:

– You need to have set goals and realistic expectations going into your passive income campaign

– It will require some type of effort or investment, in addition to periodic maintenance

– Don’t expect money to come quick or easy

– Realize that it’s the effort you put it in and the initiative you take that will define how much you can ultimately make on a passive basis

If you can live with everything mentioned above, your mind is in the right place to make some actual money while sleeping.

Avoiding Passive Income Scams

The last issue before getting into all the juicy passive income ideas is related to avoiding scams. Don’t worry, this section won’t be too long. But it’s important that you can recognize the signs that typically go with people trying to exploit your eagerness for some financial relief.

– There is a magic button that generates money

One of the classic tricks scammers are going to use will be the magic button trick. They either have some investment software with a top-secret algorithm, which helps to predict the future of the stock market. All you have to do is deposit a small amount of money and push the magic button. Then, you wait for the money to come rolling in. They are a dime-a-dozen, so avoid them at all cost.

– They promise the sun and the moon

The old saying still rings true – if it’s too good to be true, it probably is. The moment somebody gives you the idea that you can make a million dollars with only a hundred, and you can do it in two months, alarm bells should be going off.

– You don’t need any knowledge about the way the money is made

This is another popular line scammers are going to use. The fact that you don’t need any knowledge about what “they” are doing just make the process so much more attractive.

– You are approached with offers out of nowhere

Yes, those cheesy emails you get, telling you how you can be a millionaire overnight are dangerous spam. Avoid them like the black plague and you should be good to go.

What is Passive Income?

Passive income is earned from a source that the individual is not actively involved in. Unlike active income, which is determined by the number of hours worked (like a regular job), passive income requires minimal daily effort to maintain it after the initial investment of time, money, or both. The fundamental features of passive income comprise:

To begin with: Frequently requires an initial investment of either time or money. An investment is necessary for buying property to rent it out, while writing the book necessitates time.

Limited Active Management: Once established, these income streams require minimal day-to-day involvement. Rental income may need to be maintained periodically, but it usually yields dependable returns even without regular labor. For instance,

Possibility of continuous revenue generation: It may offer a steady stream of income with the potential to increase.

Diversifying your income streams can contribute to a more secure financial situation.

Common examples of passive income include:

Money earned from renting out properties is considered a rental income.

Earnings derived from stocks or mutual funds are distributed to shareholders.

Licenses provide revenue for the use of creative or inventive assets, such as patents and books. See also.

Online Courses or E-Books: Earnings from online sales.

Affiliate Marketing is a strategy that involves promoting and earning commissions for other people’s products or companies.

Creating wealth through passive income can be challenging, as it usually involves substantial investment in effort or capital.

What are the best ways to invest in passive income

Investing in passive income streams can be a strategic way to build wealth over time. Here are some of the best ways to invest in passive income, each with its own set of considerations:

Real Estate Investments:

Rental Properties: Buying property to rent out can provide a steady stream of income. A substantial initial outlay is necessary and it can involve ongoing property management.

The ability to invest in real estate through REITs allows for the non-owned ownership of tangible assets. Direct ownership is less risky than investing in property, and they frequently provide high dividend payouts. Additionally, they are more fluid.

Dividend Stocks and Mutual Funds: The use of dividend-paying stocks can result in consistent financial gains. Find companies that have historically generated high dividends.

Dividend-stock mutual funds and exchange-traded funds (ETFs) offer diversification and professional management.

Peer-to-Peer Lending: Lending Club and Prosper are online lending platforms that provide individuals and small businesses with passive income, which can be earned through interest payments.

Create Digital Products: Earnings can be obtained through e-books, online courses, or stock photography. Initially, creating these products may yield positive results as they become more profitable through sales.

High-Interest Savings Accounts and Certificates of Deposit (CDs): Despite being less risky than other investments, these are low-risk investments that generate passive income through interest.

Annuities: Annuities are insurance policies that can provide a stable income for retirement. They can be complex and usually require speaking with a financial advisor.

Automated Investment Platforms (Robo-Advisors): Unlike traditional investment management services, robo-advisors can provide you with automated portfolio management and charge less for managed assets.

Affiliate Marketing: Earn commissions by advertising and selling products from other individuals, provided you have a blog or e-commerce channel or social media presence.

Royalties from Intellectual Property: Income from patents and royalties can be passive, as it can come from books, music or software.

Business Investments: The benefits of investing in a business as’silent partner’ are evident even when there is no daily involvement.

When considering passive income investments, it’s important to consider your risk tolerance, investment goals, and capital requirements. Diversifying passive income streams can also help to minimize risk. e.g. To ensure the success of your investment, it’s important to conduct thorough research or seek guidance from an advisor.

How to make $1,000 a month passively?

To make $1,000 a month passively, you can consider the following strategies:

1. Invest in stocks or index funds that pay dividends and receive regular passive income.

2. Create and sell digital products or resources, such as e-books, online courses, or stock photos, on platforms like Etsy or Teachable.

3. Rent out a spare room or property on platforms like Airbnb or VRBO.

4. Launch a blog or website and generate income through advertising, sponsored content, or affiliate marketing.

5. Peer-to-peer lending platforms or real estate crowdfunding can be used to generate passive income through interest or rental payments.

6. Create and sell digital assets, such as website templates, graphics, or WordPress themes, on marketplaces like ThemeForest or Creative Market.

7. To earn interest on your money, you can open a high-yield savings account or CD. Or both.

8. Start YouTube and earn passive income through advertisements, sponsorships or product tagging.

9. Rent a house and make the most of your monthly income.

10. Launch a subscription service or membership site, offering exclusive content or products for recurring monthly payments.

Creating passive income streams requires initial effort and investment to achieve this. To achieve this, it’s crucial to research and choose the strategies that are most effective for your interests, skills, and risk tolerance.

How do beginners start passive income?

The steps below are a starting point for beginners looking to generate passive income:

Determine a passive income source: Evaluate and pick an appropriate passive source that suits your profession and interests. Commonly used approaches include affiliate marketing, digital product design and sales, rental properties, and dividend investing.

Build your presence online: If you’re aiming for passive income, establish a website or blog to create an online presence. Make your website search engine friendly and include valuable content to attract visitors.

Build an audience: Increase your audience through content creation, social media and email marketing. Engage in problem-solving, educating your audience, and providing valuable information to enhance credibility.

Monetize your platform: Implement monetization strategies that are relevant to your chosen passive income stream. Affiliate marketing involves using affiliate links to market products or services. When developing digital products, develop and market them on platforms like Teachable or Gumroad.

Find methods to automate your passive income stream and reduce manual labor.?… The options for automating email campaigns, utilizing tools to create content more efficiently, or outsourcing certain tasks are available.

Evaluate and refine: Regularly assess the effectiveness of your passive income stream. Identify the areas that need improvement and adapt your approach to maximize your earnings.

Remember that it takes some effort to establish a passive income source. Persistence and consistency are essential for success.

How to make $100,000 in passive income?

The methods to generate $100,000 in passive income are as follows:

To receive regular cash dividends, invest in stocks or exchange-traded funds (ETFs). Some stocks pay dividend payments.

Build a portfolio of rental properties and collect rental income from tenants.

Launch and trade digital content such as courses, e-books, or software that generates revenue incrementally.

Rent from REITs that allocate rental profits to shareholders.

Launch an online platform with a considerable number of visitors and generate income from affiliate marketing, sponsored content or display advertising.

P2P lending platforms or crowdfunded real estate projects are good options for investors looking to generate passive income through interest payments.

Start a dropshipping or e-commerce business and leverage automation tools to minimize active involvement.

Purchase an existing business or franchise that generates consistent cash flow.

It should be noted that obtaining a substantial passive income involves time, labor, and sometimes significant financial resources. Prior to making a decision on which strategy(s) to use, it’s crucial to conduct thorough research and evaluate each one thoroughly.

How can I make passive money right now?

Passive income can be earned in various ways at present:

Invest in stocks or index funds that pay dividends.

Taking on Airbnb or other similar sites.

Develop digital products or online courses for sale.

Kick off affiliate marketing by promoting and earning commissions.

Produce and self-publish an e-book through platforms such as Amazon Kindle Direct Publishing.

Invest in peer-to-peer lending platforms.

Launch a YouTube channel, and make money from ads and sponsorships.

Develop mobile apps or software for sale.

Real estate investment trusts (REITs) – invest.

Create and sell a blog or website through advertisements, sponsored posts, or affiliate links.

Maintaining a steady stream of income through passive income requires ongoing efforts, but it is still an effective method. This is important to remember.

How To Make A Profitable Real Estate Investment

High Paying Affiliate Programs

Finding Top Work From Home Jobs

Top Home Based Business Ideas For Moms

Legitimate Online Business Opportunities